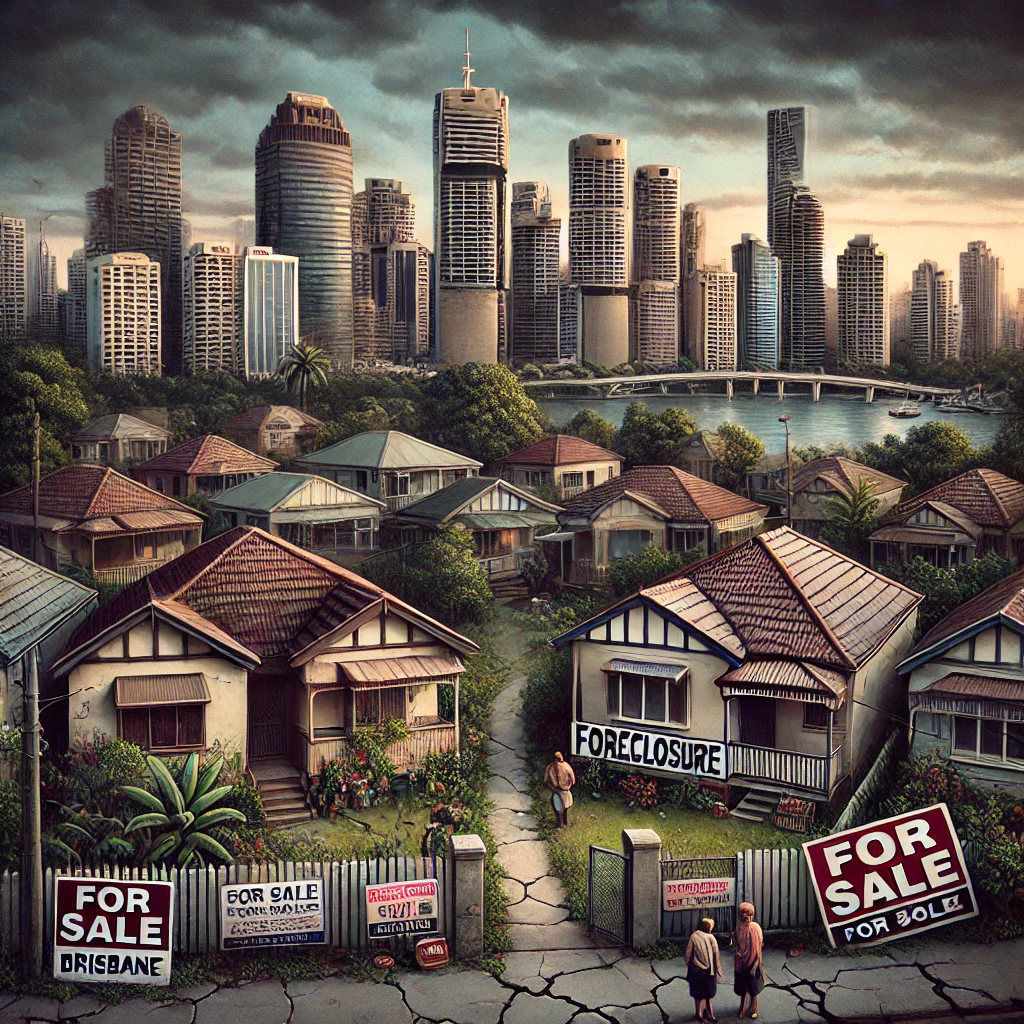

The question of whether the Brisbane property market will crash has been a topic of discussion among real estate professionals, investors, and homeowners alike. While predicting market movements with certainty is impossible, it is possible to analyze key factors influencing the market and assess the likelihood of a significant downturn.

Brisbane’s Recent Market Trends

In recent years, Brisbane’s property market has experienced steady growth, fueled by affordability relative to Sydney and Melbourne, population growth, and infrastructure investments. During the COVID-19 pandemic, Brisbane saw an influx of interstate migrants seeking lifestyle changes, boosting demand for housing. This trend contributed to rising property prices, even as other markets faced uncertainty.

However, since mid-2023, Brisbane’s market has cooled in response to increasing interest rates and broader economic conditions. Rising borrowing costs have tempered buyer demand, while inflation has tightened household budgets. Despite these headwinds, Brisbane has shown resilience compared to other Australian cities, thanks to its strong fundamentals.

Factors Supporting Brisbane’s Market

- Population Growth:

Brisbane continues to attract people from interstate and overseas, particularly due to its relatively affordable housing, employment opportunities, and lifestyle appeal. This influx supports demand for property, mitigating the risk of a crash. - Infrastructure Projects:

Major infrastructure developments, such as the Cross River Rail and preparations for the 2032 Brisbane Olympics, enhance the city’s appeal and long-term economic prospects. These projects create jobs, improve connectivity, and increase the desirability of the region, underpinning property values. - Housing Supply Constraints:

Brisbane faces constraints in housing supply due to land-use policies and construction challenges. These limitations help maintain a balance between supply and demand, reducing the likelihood of a significant price drop.

Risks to the Market

- Economic Pressures:

Rising interest rates are a key risk to Brisbane’s property market. Higher borrowing costs reduce buyer purchasing power and may lead to a slowdown in sales activity. Additionally, if unemployment rates rise or economic growth falters, market confidence could decline. - Investor Retreat:

Investors have been integral to Brisbane’s market growth, but changes to lending regulations, higher interest rates, and rental yield pressures could lead to reduced investor activity. - Global Economic Conditions:

Global economic challenges, such as inflationary pressures and geopolitical tensions, can impact consumer confidence and investment in property markets, including Brisbane’s.

Will the Market Crash?

While the Brisbane property market is likely to face challenges, a full-blown crash appears unlikely. Unlike speculative bubbles that can lead to sharp price corrections, Brisbane’s growth has been supported by solid demand drivers and economic fundamentals.

Instead of a crash, the market may experience a period of stabilization or moderate price declines in some segments, particularly high-end or highly leveraged properties. For those with a long-term perspective, such corrections may present opportunities.

Conclusion

The Brisbane property market’s resilience, supported by population growth, infrastructure investments, and limited supply, suggests that a dramatic crash is improbable. While short-term adjustments may occur, the city’s strong fundamentals position it for sustainable growth in the years to come. Investors and homeowners should stay informed, plan for interest rate fluctuations, and take a measured approach to navigate the evolving market landscape.